Some analysts pointed out that there are multiple internal and external reasons behind the problems in the European battery industry.

According to the EU official website, the European Battery Alliance will hold a high-level meeting in March 2023. The meeting acknowledged that the European battery industry faces internal structural challenges. By 2025, Europe will need more than 800,000 skilled workers, and the costs for companies to obtain energy, land, and government permits will be high. In addition, Europe currently produces only 1% of critical raw materials for batteries and is still far from self-sufficiency.

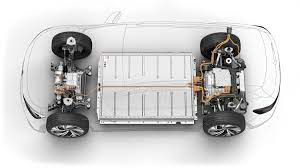

"The European Union faces a series of difficulties that cannot be ignored in developing its domestic battery industry chain." Sun Yanhong said, "In all aspects of the mining and refining of critical raw materials, the production of crucial battery components, and battery processing and assembly, the European domestic battery industry chain is quite fragile. In terms of vital raw materials, mining, and refining, European countries have minimal local reserves of cobalt, nickel, manganese, and graphite and have little control over overseas mining. In terms of the production of crucial battery components, European countries have a lot of difficulties in terms of production technology, labor skills, equipment manufacturers, and production. Neither has an advantage in cost; in terms of battery processing and assembly, EU countries are also at a relative disadvantage in terms of technology and cost. Many shortcomings will be difficult to make up for in a short period.

Europe, as a gathering area for the global automobile industry for a long time, has increasingly revealed inherent constraints in the process of electrification transformation. European automakers' attempts at electrification are still possible. For example, BMW launched its first mass-produced electric model, the i3, in 2013, almost at the same time as Tesla launched the Model S. However, Europe has long-term doubts about the transformation of the automobile industry, which directly affects the development progress of Europe's new energy industry chain. At present, there are not enough types of manufacturers on the European electric vehicle "track," making it difficult to form an industrial chain covering the entire chain and critical nodes. In addition, there needs to be more representative companies such as Tesla to cultivate the new energy industry chain, including batteries, efficiently, so the industry chain is relatively less competitive.

"Europe has always faced the challenge of a lack of coordination between countries and difficulty in fully tapping the potential of the large internal market. In recent years, countries such as Germany, France, and Italy have competed to formulate R&D and investment plans in the local battery industry chain. Still, there has always been a lack of implementation. Effective coordination makes it difficult to form synergy, resulting in problems such as waste of resources and difficulty in taking advantage of economies of scale," said Sun Yanhong.

External competition has also squeezed the European battery industry.

"The United States has triggered a massive subsidy competition." The New York Times reported that many battery companies now believe that applying for funding in Europe is complicated and slow. The head of battery manufacturer Freyr said that the more straightforward and faster Inflation Reduction Act in the United States has prompted a "sharp increase in interest in producing batteries in the United States."

According to reports, 16 European companies and institutions jointly sent a letter to the European Commission in September 2023. The letter reads, "The United States is implementing high-dollar investment plans, while the European investment environment has further deteriorated because of the ongoing crisis in Ukraine." Existing EU funding is "a patchwork of inadequate, uncoordinated and complex programs." It focuses primarily on research and development rather than mass production—more than these, projects and funding are needed to drive Europe's green transition.

"In the field of batteries, the relationship between the US and EU allies may become a 'zero-sum game.' Under the current new pattern of the global battery industry, the European battery industry needs more resources to expand production, and the squeeze from the US battery industry and policies will further affect The development space of the European battery industry.

Supplier

Graphite-crop corporate HQ, founded on October 17, 2008, is a high-tech enterprise committed to the research and development, production, processing, sales and technical services of lithium ion battery anode materials. After more than 10 years of development, the company has gradually developed into a diversified product structure with natural graphite, artificial graphite, composite graphite, intermediate phase and other negative materials (silicon carbon materials, etc.). The products are widely used in high-end lithium ion digital, power and energy storage batteries.If you are looking for graphite powder for battery li-ion anode, click on the needed products and send us an inquiry:sales@graphite-corp.com