Professional graphite material supplier, graphite for EV, grease, furnace and any other industries.

Currently, commercially available lithium-ion battery anode materials are still mainly graphite (especially artificial graphite). This is the result of a combination of factors, including technological maturity, cost, safety, and supply chain support. The following analysis examines the dominant reasons from six dimensions:

I. Mature technology and stable performance

1. Theoretical capacity and process optimization

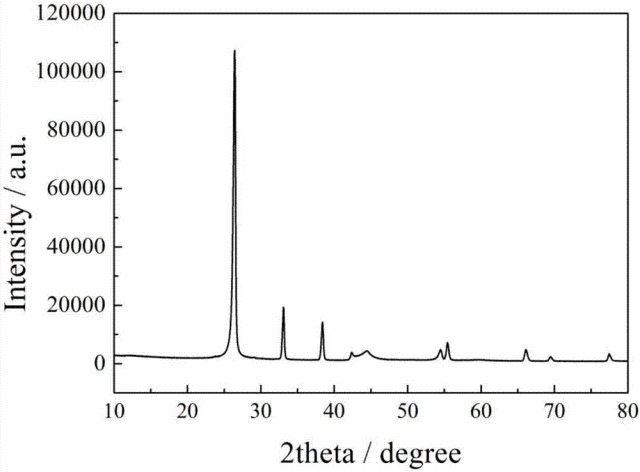

Graphite has a theoretical specific capacity of 372 mAh/g, which is lower than that of silicon-based materials (4200 mAh/g) or lithium metal (3860 mAh/g). However, its layered structure is stable, and the volume change during lithium-ion insertion/extraction is small (<10%), resulting in a cycle life of thousands of cycles. In contrast, silicon-based materials expand by up to 300% during lithium insertion, which easily leads to electrode pulverization and SEI film rupture, significantly shortening the cycle life.

2. Conductivity and rate performance

Graphite possesses excellent electronic conductivity and ion diffusion capabilities, supporting high-rate charge and discharge. For example, nickel-doped artificial graphite (OCHN structure) retains a capacity of 220 mAh/g at a current of 1 A/g, which is 68.7% of that of conventional graphite. In contrast, silicon-based or metal oxide anodes have low ion diffusion rates and poor high-rate performance.

II. Cost and Supply Chain Advantages

1. Cost reduction effect of economies of scale

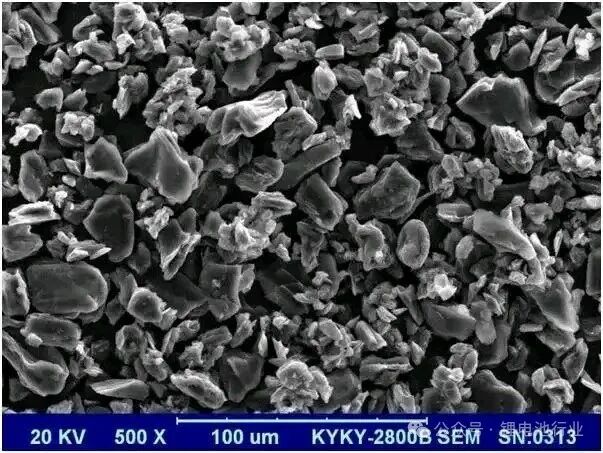

Graphite anode raw materials (petroleum coke, pitch coke) are widely available, and processing technologies (crushing, graphitization) are mature and highly scalable. The cost of artificial graphite is approximately 80,000-100,000 RMB/ton, while the cost of silicon-carbon composite anodes is as high as 200,000-300,000 RMB/ton, and requires complex processes such as nano-sizing and pre-lithiation.

2. Complete industrial chain supporting facilities

Over 80% of the world’s anode material production capacity is concentrated in China, with leading companies having annual production capacities exceeding 100,000 tons. New projects such as the 7 billion yuan graphene-coated anode base in Bijie and the 10,000-ton silicon-carbon project in Ordos still require time to be implemented, and graphite will remain dominant in the short term.

III. Safety and Engineering Adaptability

1. Low voltage plateau and dendrite suppression

Graphite operates at a voltage close to the lithium metal deposition potential (0.1V vs. Li⁺/Li), but still above the critical potential for lithium dendrite formation. Lithium metal anodes are prone to dendrite formation in liquid electrolytes due to uneven deposition, posing a short-circuit risk. While solid-state batteries can mitigate this problem, they are not yet commercially available on a large scale.

2. Thermal stability and compatibility

Graphite anodes exhibit good compatibility with existing electrolytes (EC-based) and separators (PP/PE), with a thermal runaway temperature >300℃. Silicon-based materials are prone to electrode deformation due to volume expansion, increasing the risk of thermal runaway; while lithium titanate (LTO) offers high safety, its energy density is too low (175mAh/g), limiting its applications.

IV. The bottleneck of alternative materials has not yet been overcome.

- Silicon-based anodes: Volume expansion and first-efficiency challenges

Despite the introduction of the Si+graphite synergistic solution (improving lifespan by 20%), the expansion problem still needs to be addressed for pure silicon anodes. Currently, commercially available products mainly use silicon doping (5-10%), with some companies’ silicon-carbon products having a capacity of 600mAh/g and an initial efficiency of only 88.7%, while graphite has an initial efficiency of >95%.

2. Lithium Metal Anode: Dendrites and Cycle Life Challenges

The lithium dendrite problem remains unsolved in liquid batteries and necessitates the use of solid-state electrolytes. Currently, the thickness of rolled lithium foil is only 20μm (ideally 5-6μm), and the penetration rate of all-solid-state batteries is projected to be only 20% by 2030, making it impossible to replace graphite in the short term.

3.Titanium-based/alloy materials: Energy density is a major weakness

Lithium titanate (LTO) has a cycle life of over 20,000 cycles, but its energy density is only half that of graphite, and its high voltage plateau (1.55V) leads to a decrease in the overall voltage of the cell. Alloys (Sn, Sb) are also limited by volume expansion and have not yet left the laboratory.

V. Graphite materials are also undergoing continuous innovation.

For example, companies with a foundation in graphite research or complete equipment will definitely increase their efforts to develop graphite materials with better performance. This will maximize their profits.

1. Composite modification improves performance

Graphene coating: Improves conductivity and cycling stability

Lithium aluminate modification: reduces the lithium-ion diffusion barrier and suppresses volume expansion.

Porous graphite lithium storage: Depositing nano-lithium in graphite pores to improve rate performance.

2. Break through the capacity limit

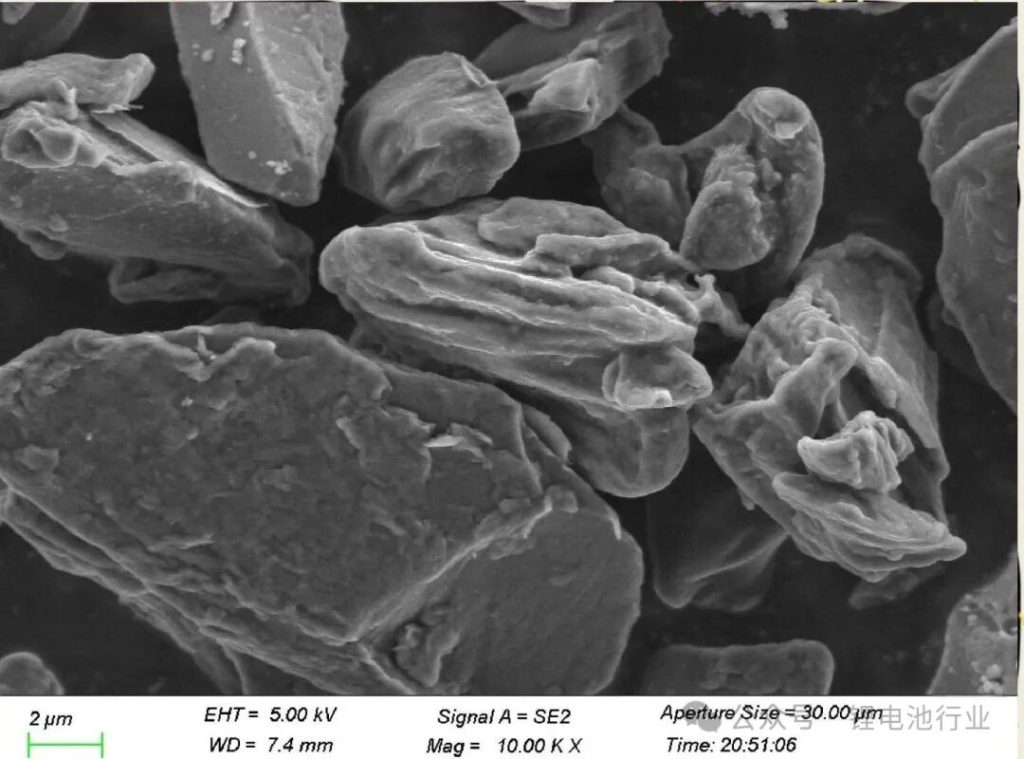

Nickel-doped artificial graphite (OCHN structure) achieves a capacity of 460 mAh/g by creating nanopores, approaching the low end of silicon-based graphite.

VI. Graphite’s dominant position will persist for a long time.

In the medium term (5-10 years), silicon-carbon composite materials will gradually increase their market penetration through nanosizing and pre-lithiation. It is estimated that by 2030, silicon-carbon will account for 30% of high-end power batteries, but graphite will still dominate the mid-to-low-end market.

Long term (10+ years): Lithium metal anodes require the support of solid-state battery industrialization, and the market size is expected to be less than 10 billion by 2030 (compared to the global anode market of over 50 billion in 2025).

Although silicon-based and lithium metal anodes represent the future direction, their engineering bottlenecks and lagging supply chains mean that graphite remains the “optimal solution” for commercial batteries. Future anode materials will move towards a gradual upgrade path of “graphite matrix + high-capacity material composite,” rather than a disruptive replacement.